Metaverse Trading Academy is best trading academy in india to learn stock trading using order flow, market profile, volume profile, option chain etc.

Rajkot, Gujarat, India

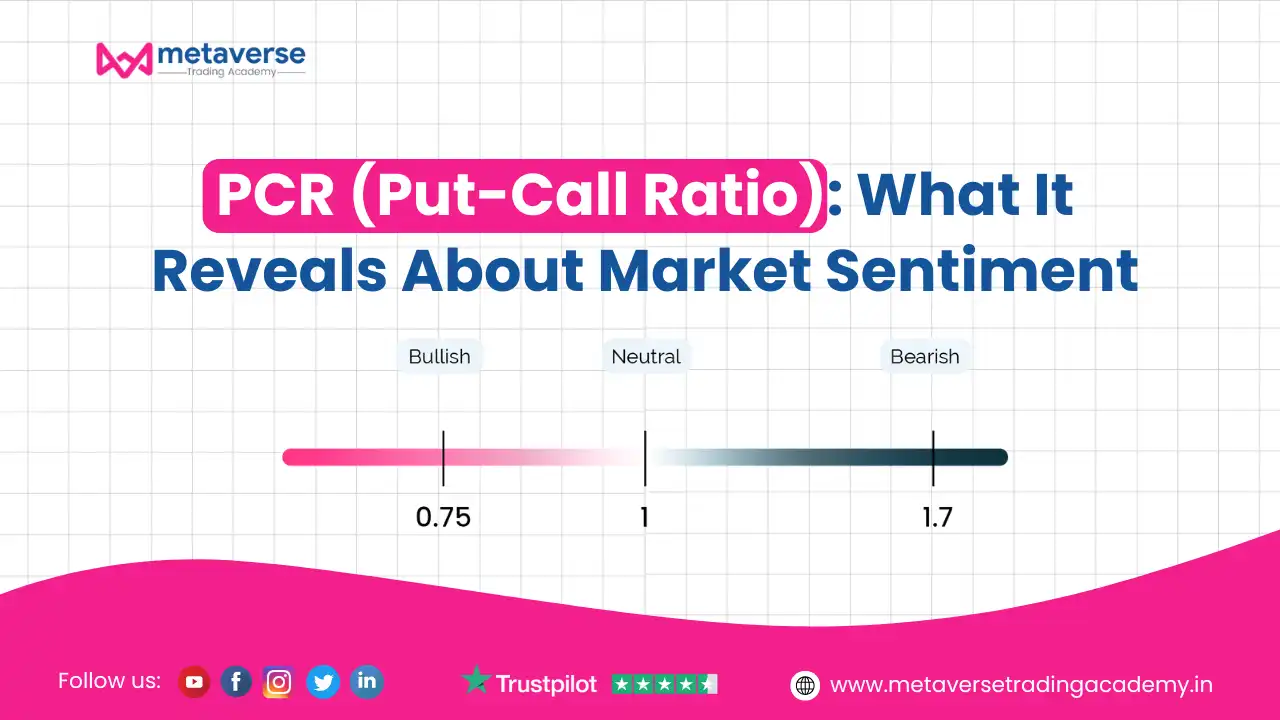

In the dynamic world of financial markets, understanding investor sentiment is key to making informed trading decisions. One of the most reliable tools to gauge market mood is the Put-Call Ratio (PCR). This powerful indicator provides a snapshot of bullish or bearish sentiments, helping traders anticipate potential market movements. By comparing the volume of put options (bets that the market will fall) to call options (bets on a market rise), the PCR helps to decode whether fear or greed dominates the market.

But why is the Put-Call Ratio so crucial? Because it offers a real-time glimpse into market psychology, serving as a barometer for contrarian strategies and risk management. Whether you’re a seasoned investor or a beginner, mastering the PCR can refine your approach to both short-term trades and long-term investments.

In this guide, we’ll dive into actionable insights on understanding and leveraging the Put-Call Ratio to elevate your option chain market strategies. You’ll learn how to interpret its signals, avoid common pitfalls, and make smarter decisions.

The Put-Call Ratio is a numerical value derived by dividing the total number of traded put options by call options in a given period.

Key Formula:

PCR = (Volume of Put Options) ÷ (Volume of Call Options)

A higher PCR (>1) suggests bearish sentiment, as puts outnumber calls. Conversely, a lower PCR (<1) reflects bullish sentiment, with more traders buying calls than puts.

The PCR often oscillates around a mean value. Extreme highs or lows signal market turning points.

Practical Steps:

Extreme PCR values often indicate crowd bias, which contrarian investors can exploit.

Pro Tip:

Combine the Put-Call Ratio with technical indicators like RSI (Relative Strength Index) for stronger signals.

The PCR is particularly effective for assessing sentiment in major indices like the S&P 500 or NASDAQ.

Tip:

The PCR can also be applied to individual stocks to gauge sentiment and anticipate price moves.

While the Put-Call Ratio is invaluable, it has limitations:

Understand the historical PCR ranges for the market or asset you’re analyzing.

Focus on open interest alongside volume for deeper insights.

Analyze PCR trends over days or weeks to identify consistent patterns.

Pair the PCR with:

The Put-Call Ratio is more than just a number—it’s a window into the market’s collective psychology. By understanding and applying the PCR, traders can uncover hidden sentiment trends, anticipate reversals, and make data-driven decisions.

Whether you’re gauging index sentiment or pinpointing opportunities in individual stocks, the Put-Call Ratio remains a cornerstone of market analysis. When used wisely, it not only sharpens your trading strategy but also empowers you to navigate market volatility with confidence.

Take your trading to the next level—start monitoring the Put-Call Ratio today, and pair it with complementary tools for unparalleled insights. Ready to explore more? Dive into our advanced guides on order flow analysis and stay ahead of the market curve!

If you want to take your learning further, join Metaverse Trading Academy, where more than 50,000 students have already learned advanced strategies like Order Flow and Market Profile trading. Start your journey today at metaversetradingacademy.in.