Metaverse Trading Academy (NISM Registered) is the world leader in professional education for traders who want to succeed in any market, and any asset class.

Rajkot, Gujarat, India

In the world of trading, there are a multitude of strategies and theories that traders can utilize to improve their decision-making and ultimately, their profitability. One such strategy that has gained popularity in recent years is the Volume Weighted Average Price (VWAP) theory. However, VWAP is just one of the many trading concepts that traders can use to analyze and understand the market.

In this trading guide, we will delve deeper into the world of trading and explore some lesser-known yet highly effective concepts such as Delta Divergence, Option Chain, and Bell Curve. These concepts can help traders make more informed trading decisions and navigate the often unpredictable waters of the stock market. By the end of this guide, traders will have a better understanding of how these concepts work and how they can be applied in real-world trading scenarios to improve their chances of success.

The Volume-Weighted Average Price (VWAP) theory is a market analysis technique used to assess the average price at which a security is traded over a specified period of time. The VWAP is calculated by summing the total value traded (price multiplied by volume) and dividing it by the total volume traded over the specified time frame. This metric is often used by traders and investors as a benchmark to evaluate the performance of their trades.

According to VWAP theory, if the current price of a security is above the VWAP, it is considered to be trading at a premium, and if it is below the VWAP, it is considered to be trading at a discount. Traders and investors use this theory to determine if a security is overbought or oversold and to identify potential trading opportunities. Additionally, VWAP can also be used as a tool to manage and execute large trades, as it provides an objective way to assess the fair price of a security and to determine the best time to execute a trade.

Delta Divergence in order flow strategy refers to the difference between the delta of an option and the underlying security’s price change. Delta measures the rate of change in an option’s price with respect to the change in the price of the underlying security. Delta Divergence occurs when the delta of an option changes in a direction opposite to the direction of the underlying security’s price movement.

In order flow analysis, delta divergence can be an important signal for traders because it can indicate changes in market sentiment and potential shifts in buying or selling pressure. For example, if the delta of a call option increases while the underlying stock price decreases, this could indicate that traders are becoming more bullish and that buying pressure is increasing. On the other hand, if the delta of a call option decreases while the underlying stock price increases, this could indicate that traders are becoming more bearish and that selling pressure is increasing.

Delta Divergence analysis can be used in conjunction with other order flow indicators, such as volume profile, to help traders make more informed decisions. However, it is important to remember that delta divergence is just one of many factors to consider in any trading strategy, and it should not be relied on as the sole basis for making trading decisions.

Option chains are important in trading because they provide information about the various options contracts available for a particular underlying asset. An option chain is a list of all available options contracts for a specific stock, index, commodity, or other underlying assets. It includes information about the strike price, expiration date, and the bid and asks price of each option.

This information can be useful for traders because it allows them to assess the current state of the market and make informed decisions about buying and selling options. For example, traders can use option chains to identify potential trades based on the current market sentiment, implied volatility, and other factors.

Option chains can also be used to implement a variety of trading strategies, such as covered calls, protective puts, and bullish or bearish spreads. By considering the information provided in the option chain, traders can determine the potential risk and reward of each strategy, and make informed decisions about which options contracts to buy or sell.

Overall, the option chain is an important tool for traders because it provides valuable information about the options market and can be used to inform trading decisions.

The economic view is important in trading because it helps traders and investors to understand the underlying forces that drive market movements and to anticipate future price trends. Economic indicators such as gross domestic product (GDP), inflation, interest rates, employment data, and others provide insight into the overall health of an economy and can have a significant impact on financial markets.

For example, changes in interest rates set by central banks can affect the borrowing costs for businesses and consumers, and can thus influence the performance of stocks, bonds, and other financial instruments. Similarly, changes in employment data and GDP can indicate the strength of consumer spending, which is a key driver of economic growth and can impact the stock market and other financial markets.

By incorporating an economic view into their analysis, traders and investors can make more informed decisions, reduce the risk of unexpected market movements, and potentially increase their profits. Additionally, a deep understanding of the economic environment can also provide valuable context to the current market conditions and help to identify potential market trends.

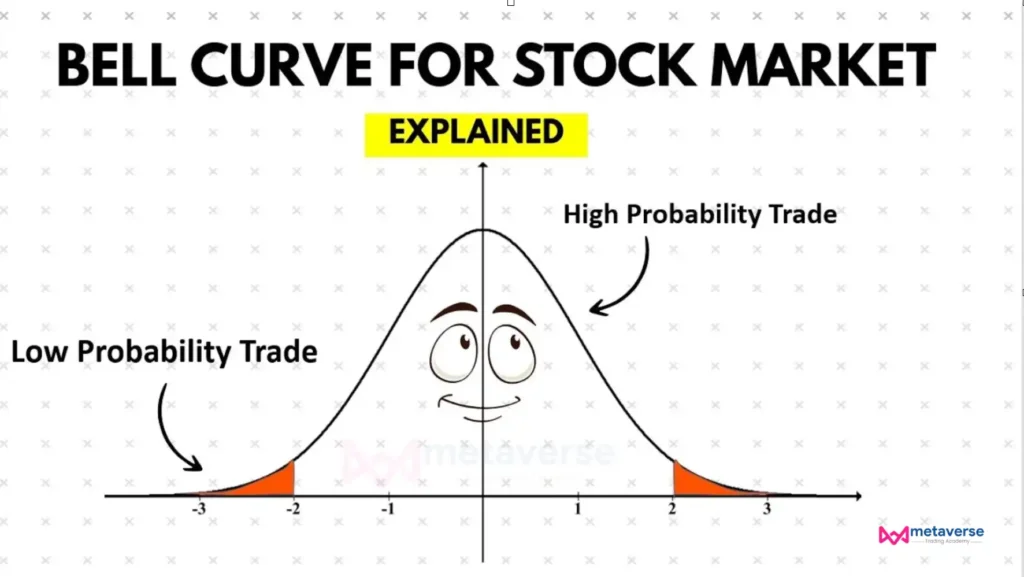

The Bell Curve is a statistical representation of a normal distribution, also known as a Gaussian distribution. In the context of market profile, it refers to the distribution of prices for a particular stock, commodity, or financial instrument over a specified period of time.

The bell curve market profile represents the average price for the instrument, with deviations from the average represented by standard deviations, creating a visual representation of price distribution. The market profile can help traders and investors identify market trends, support and resistance levels, and potential trade opportunities.