Metaverse Trading Academy is best trading academy in india to learn stock trading using order flow, market profile, volume profile, option chain etc.

Rajkot, Gujarat, India

The risk reward ratio in trading is one of the most important concepts every beginner must understand before placing real money in the market. Yet, it is often ignored in favor of entry signals, indicators, or tips.

In Indian stock markets, many traders lose money not because their analysis is wrong, but because their risk–reward ratio is poor. Even a strategy with a high win rate can fail if risk is not controlled properly.

This beginner-friendly guide explains what risk–reward ratio in trading means, why it matters, how professionals use it, and how you can apply it practically in Indian markets.

The risk–reward ratio in trading compares how much you are willing to lose on a trade versus how much you aim to gain.

In simple terms:

For example, if you risk ₹1,000 to make ₹3,000, your risk–reward ratio is 1:3.

This ratio helps traders decide whether a trade is worth taking, regardless of how confident they feel about the setup.

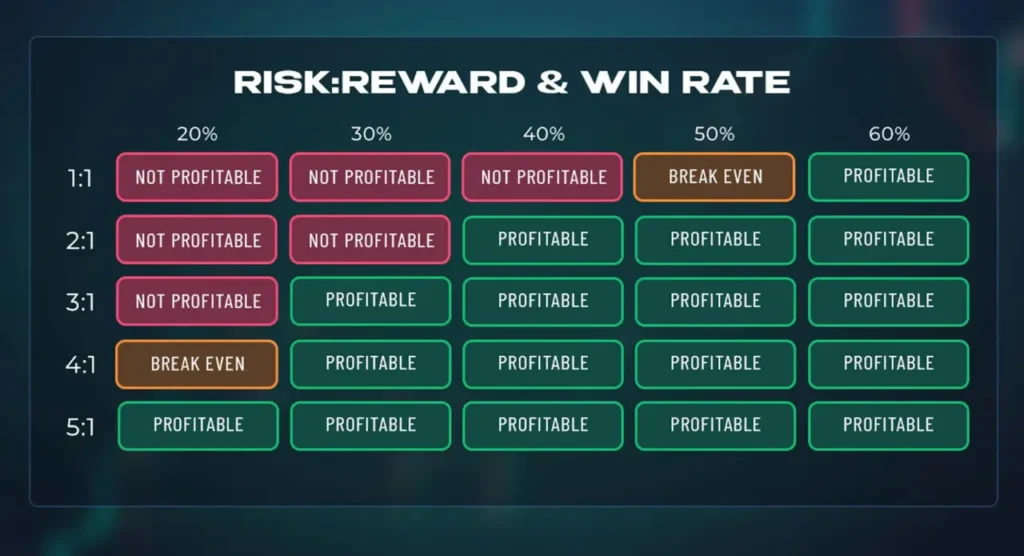

One of the biggest myths in trading is that you need to win most of your trades to be profitable. In reality, the risk reward ratio in trading matters more than the win percentage.

Here’s why:

Professional traders focus on expectancy, not prediction.

Let’s understand the risk reward ratio in trading using a practical example.

Suppose you buy a stock at ₹500.

This trade has a 1:3 risk–reward ratio.

Even if only 4 out of 10 such trades work, you still remain profitable because winners are larger than losers.

This math is what keeps traders in the game long-term.

Different traders use different ratios based on their strategy and timeframe.

Common risk–reward ratios include:

There is no “perfect” ratio. What matters is consistency and alignment with your strategy.

In intraday trading, price movements are smaller and faster. As a result, traders often work with tighter stop-losses.

Typical intraday risk–reward setups:

In Indian intraday trading, ignoring risk–reward often leads to overtrading and revenge trades.

Swing traders aim to capture moves over several days. This allows for better risk–reward opportunities.

Swing trading usually offers:

This is why swing trading is often recommended for beginners—it naturally supports better risk–reward setups.

Risk–reward behaves very differently in options.

For option buying:

For option selling:

Understanding risk reward ratio in trading is critical in options, especially in weekly expiry trading on NSE.

Institutional traders never enter trades without predefined risk and reward.

Institutions focus on:

This is why institutions can survive losing streaks, while retail traders often blow accounts.

Many beginners confuse risk–reward ratio with risk management. They are related but not the same.

A good risk–reward with poor position sizing can still cause losses.

Both must work together.

Position sizing tells you how many shares or lots to trade based on your risk.

For example:

Position size = 100 shares

This ensures one bad trade doesn’t damage your account, regardless of the risk–reward ratio.

Most beginners focus only on entries and targets.

Common mistakes include:

Ignoring risk reward ratio in trading is one of the fastest ways to blow up an account.

Risk–reward ratio directly affects your mindset.

Poor risk–reward leads to:

Good risk–reward builds:

Trading becomes calmer when risk is controlled.

Yes, and that is completely normal.

High risk–reward trades usually:

Beginners must accept losing trades as part of the process, not as failure.

Market conditions impact risk–reward opportunities.

In trending markets:

In sideways markets:

Adapting to market structure improves outcomes.

While there is no fixed rule, beginners should aim for:

Anything below this often requires very high accuracy, which beginners usually lack.

Consistency in trading does not come from winning every trade.

It comes from:

One good trade cannot make you rich, but one bad trade can break discipline.

Risk–reward ratio is not a guarantee of profits.

It does not:

It simply ensures that when you are right, you get paid more than when you are wrong.

That is the edge.

Some common misconceptions include:

In reality, consistency matters more than extremes.

Practical steps to improve include:

Small improvements in risk–reward create massive long-term impact.

Risk–reward ratio compares the potential loss to potential profit of a trade.

A minimum of 1:2 is recommended for beginners.

Yes, but it requires a very high win rate and discipline.

Yes, it is critical to avoid large losses in fast markets.

Absolutely. Options trading requires even stricter risk–reward control.

No, but it improves long-term expectancy and survival.

The risk reward ratio in trading is not just a concept—it is a survival tool. Traders who ignore it may win occasionally, but they rarely last long in the market.

By focusing on controlled risk and meaningful reward, beginners shift from gambling to structured trading. Over time, this discipline compounds into consistency.

At Metaverse Trading Academy, we emphasize risk-first trading, strong psychology, and structured decision-making—because protecting capital always comes before chasing profits.

Metaverse Trading Academy empowers traders with AI-driven education, trading psychology insights, and practical investment strategies for India’s evolving market.

Learn more at https://metaversetradingacademy.in