Metaverse Trading Academy is best trading academy in india to learn stock trading using order flow, market profile, volume profile, option chain etc.

Rajkot, Gujarat, India

Investing in the stock market is a promising journey that excites many newcomers. However, for new traders, it often turns into a costly learning experience. Losing money in the stock market is common, especially for those unaware of its complexities.

Understanding the reasons why new traders are losing money can help them avoid these pitfalls and set them on the path to success. Here are nine detailed reasons why new traders lose money in the stock market, along with actionable tips to help them succeed.

One of the main reasons why new traders are losing money is the lack of proper education about the stock market. Many enter trading without understanding:

Without this knowledge, new traders rely on guesswork rather than informed decisions.

Solution:

Start with a strong educational foundation. Learn trading basics, attend webinars, and follow trusted financial experts. Knowledge empowers traders to make better decisions.

Emotions such as fear, greed, and excitement often lead new traders to make impulsive decisions. For instance:

Emotional trading clouds judgment, leading to losses.

Solution:

Stick to a well-defined trading strategy and avoid reacting emotionally to short-term market movements. Use logic and analysis to make decisions.

Many new traders think frequent trading leads to more profits. Instead, over-trading often results in:

Solution:

Trade selectively. Focus on quality opportunities rather than quantity. Patience often leads to better results.

The allure of trending stocks is another reason why new traders are losing money. Buying stocks that are already overvalued without analyzing their fundamentals can backfire when the hype dies down.

Solution:

Research thoroughly before investing. Focus on stocks with strong fundamentals, long-term potential, and reasonable valuations.

New traders often overlook risk management, exposing themselves to significant losses. Common mistakes include:

Solution:

Have a clear risk management strategy. Limit exposure to high-risk trades and always set stop-loss levels to minimize potential losses.

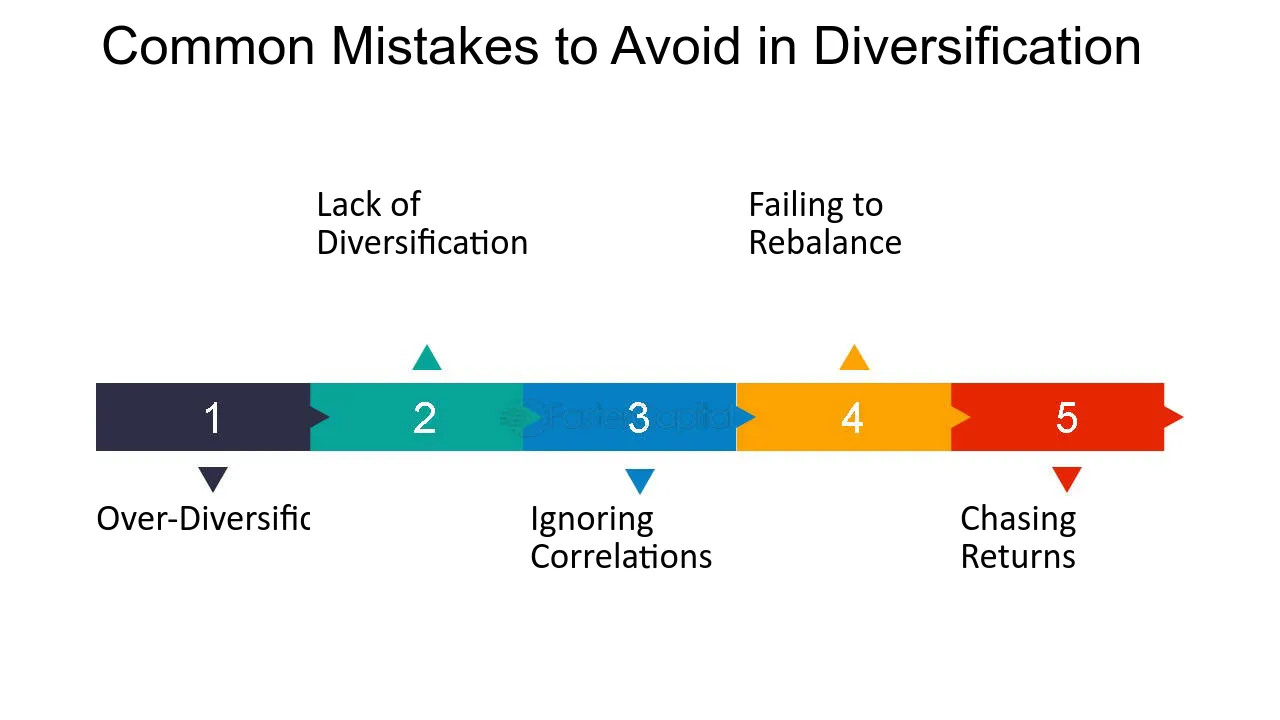

Another common reason why new traders are losing money is putting all their investments into a few stocks or a single sector. This concentration increases the risk of loss if one investment performs poorly.

Solution:

Diversify your portfolio across multiple stocks, sectors, and asset classes to spread risk. Diversification protects against unexpected market downturns.

Trading without a defined plan is a recipe for failure. Many new traders jump into the market without setting clear goals, strategies, or risk tolerance. This lack of direction leads to inconsistent and impulsive trades.

Solution:

Create a detailed trading plan that outlines:

Stick to your plan, and avoid deviating due to short-term market movements.

New traders often fail to account for the volatility of the stock market. Sudden price swings can lead to panic, especially for those who lack experience.

Solution:

Understand that volatility is a natural part of the market. Use tools like trailing stop-loss orders and invest in low-volatility stocks initially to build confidence.

The promise of quick wealth through stock trading tempts many newcomers. They often follow unreliable tips, invest in penny stocks, or try day trading without sufficient knowledge.

Solution:

Avoid shortcuts. Trading success requires time, patience, and consistent effort. Rely on well-researched strategies rather than speculation or unverified advice.

Losing money in the stock market is a common challenge for beginners, but understanding the reasons why new traders are losing money can help them make better choices. The key is to focus on education, discipline, and risk management. Developing a solid trading plan, avoiding impulsive decisions, and diversifying investments can significantly reduce the chances of losses.

While the journey of stock trading comes with ups and downs, staying persistent and learning from mistakes will help new traders improve. Remember, every successful trader once started as a beginner. By avoiding these common pitfalls, you can enhance your trading experience and increase your chances of success.

If you want to take your learning further, join Metaverse Trading Academy, where more than 50,000 students have already learned advanced strategies like Order Flow and Market Profile trading. Start your journey today at metaversetradingacademy.in.