Mastering the Art of Price Action Trading

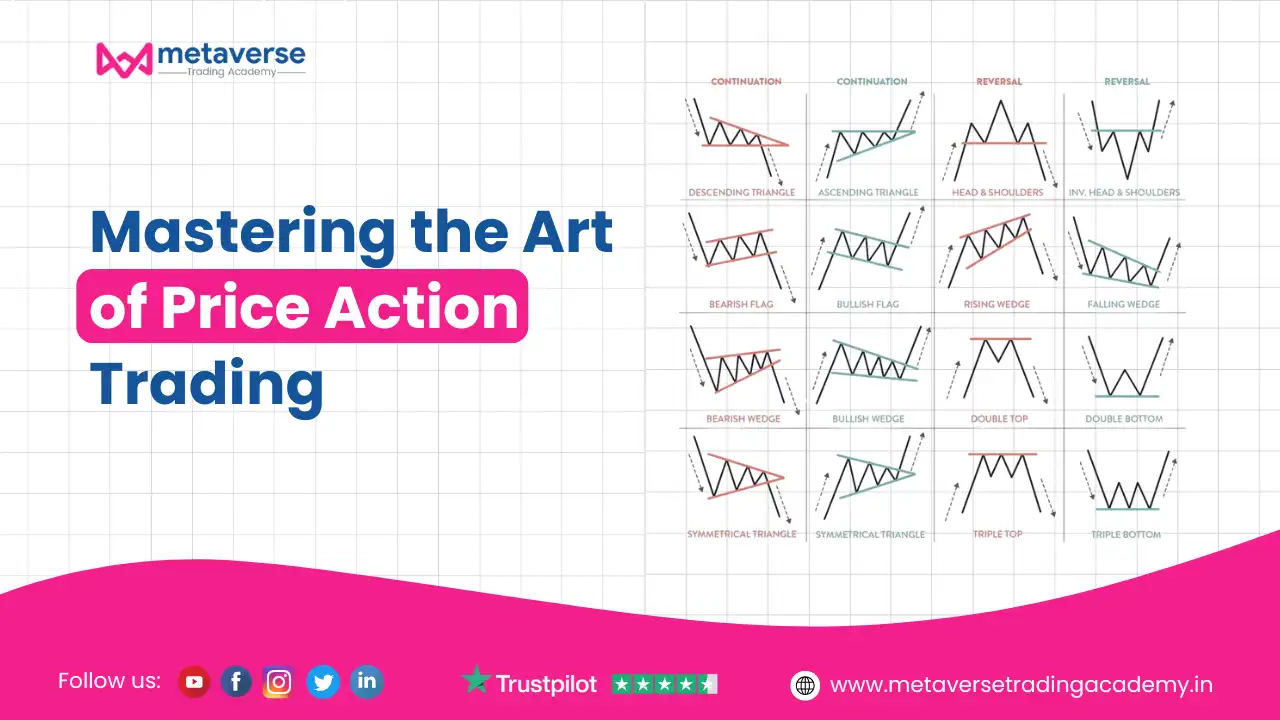

In the ever-evolving world of financial markets, Price Action has become a cornerstone for traders seeking a pure and disciplined approach to trading. Unlike strategies relying heavily on indicators or algorithms, Price Action focuses on interpreting raw market data directly from charts. It’s the art of reading and analyzing price movements to predict future trends and make informed trading decisions.

For beginners, Price Action offers simplicity, stripping away the noise of over-complicated tools. For advanced traders, it provides a deeper understanding of market psychology and dynamics. This combination makes it a versatile strategy suitable for traders at all levels.

But why is mastering Price Action essential? Because it allows you to:

In this comprehensive guide, we’ll walk you through Price Action trading, from foundational principles to advanced techniques, equipping you with actionable insights to trade confidently in any market condition.

At its core, Price Action is the movement of a security’s price plotted over time. By studying these movements, traders can make predictions without relying on external indicators. It emphasizes patterns, trends, and price levels created by market participants.

Pure Data Analysis: No Reliance on Lagging Indicators

One of the core advantages of Price Action trading is its reliance on raw price movements rather than lagging indicators. Indicators, such as moving averages or oscillators, are derived from past price data, meaning they reflect market conditions after changes have occurred. While useful in certain contexts, these tools can delay decision-making, causing traders to miss optimal entry or exit points.

Price Action eliminates this delay by focusing solely on the current price and how it behaves in real-time. It emphasizes the natural ebb and flow of the market, allowing traders to interpret trends, reversals, and momentum without external tools clouding their judgment.For example, a candlestick pattern like a pin bar or engulfing bar offers immediate insights into market sentiment, such as rejection at key levels or strong directional bias. This immediacy enables traders to act with precision, adapting to market changes as they happen.

By mastering Price Action, traders can develop strategies that are not only simple but also flexible across various markets and timeframes. It’s a direct approach that empowers traders to trust the story told by the price itself, unfiltered by the delay of indicators.

Versatility of Price Action Trading Across Markets

Price Action trading stands out for its remarkable versatility, making it a favored approach across various financial markets, including stocks, forex, cryptocurrencies, and commodities. This adaptability arises from its core principle: analyzing raw price movements to gauge market sentiment, trends, and potential reversals.Unlike strategies reliant on specific indicators tailored to certain markets, Price Action operates independently of external tools.

Its focus on universal price behaviors, such as support and resistance levels, candlestick patterns, and trendlines, ensures its applicability to any asset.For instance, a breakout pattern in the stock market is interpreted the same way in forex or crypto. Similarly, key levels of supply and demand observed in commodities follow the same logical patterns in other markets. This consistency allows traders to apply their skills across diverse asset classes without needing to learn new techniques or systems.

Additionally, Price Action trading works effectively on different timeframes, from intraday charts to weekly analyses, making it suitable for scalpers, swing traders, and long-term investors alike.

By mastering Price Action, traders gain a powerful and flexible toolkit, enabling them to navigate various market conditions and assets with confidence and precision. This universality makes it a cornerstone of successful trading strategies worldwide.

Market Sentiment Insights Through Price Action:

Price Action trading offers unparalleled insights into market sentiment by directly analyzing buyer and seller behavior. Unlike strategies that rely on lagging indicators, Price Action reveals the market’s real-time psychology through raw price movements, empowering traders to make informed decisions based on the forces of supply and demand. Candlestick patterns, trendlines, and support and resistance levels are key tools in understanding market sentiment. For example:

By interpreting these patterns, traders can discern when buyers or sellers are gaining strength and adapt their strategies accordingly. For instance, a rejection at a key resistance level may indicate an upcoming price drop, offering an opportunity to short the market.

This clarity into market sentiment provides a real-time edge, eliminating delays caused by indicators and fostering a deeper understanding of price behavior. Mastering Price Action equips traders to anticipate movements effectively, positioning themselves ahead of the crowd in dynamic markets.

Candlestick charts are the backbone of Price Action analysis. Each candlestick represents a specific time period, providing four critical pieces of information:

Familiarize yourself with basic candlestick patterns such as:

Pin Bars: A Key Tool in Price Action Trading

Pin bars are among the most powerful and widely recognized candlestick patterns in Price Action trading, offering clear insights into potential market reversals. Characterized by a long wick and a small body, a pin bar reflects a strong rejection of price at a specific level, providing traders with valuable clues about market sentiment.

The effectiveness of pin bars lies in their simplicity. Traders use them to identify key turning points in the market, especially when they appear at significant support or resistance levels. For added confidence, pin bars are often validated by confluence factors like trendlines or Fibonacci retracements.

Mastering the identification and use of pin bars allows traders to anticipate reversals early, offering precise entry and exit opportunities. Their reliability makes them a cornerstone of successful Price Action strategies across all financial markets.

Engulfing Bars: A Momentum Indicator in Price Action Trading

Engulfing bars are a critical candlestick pattern in Price Action trading, signaling strong market momentum and potential trend reversals. These patterns occur when a single candlestick completely “engulfs” the body of the previous one, indicating a significant shift in buyer or seller dominance.

Engulfing bars are powerful because they reflect clear and decisive shifts in market sentiment. Traders often use these patterns to identify high-probability entry points, especially when supported by other confluence factors like trendlines or Fibonacci levels.

Their versatility across timeframes and markets makes engulfing bars a staple of Price Action strategies. By recognizing these patterns, traders can capitalize on momentum shifts and align themselves with the prevailing market trend.

Inside Bars: A Window into Market Consolidation and Breakout Potential

Inside bars are a key Price Action pattern that signifies market consolidation and often precede significant breakout movements. This candlestick pattern forms when the current candle’s high and low are entirely within the range of the previous candle, reflecting indecision among buyers and sellers.

What Inside Bars Represent:

Trading Inside Bars:

Inside bars are versatile and appear across markets and timeframes, making them a valuable tool for traders seeking clarity during periods of indecision. By mastering this pattern, traders can anticipate breakouts and position themselves effectively for strong market moves.

Support and resistance levels are crucial to Price Action. These levels represent areas where price has historically reversed or consolidated.

To identify these levels:

Understanding the trend is vital for aligning your trades with market momentum. Price Action trends can be categorized as:

Pro Tip: Use trendlines to visually track the direction of the market.

Breakouts occur when price moves outside of established support or resistance levels. Successful breakout trading involves:

Not all breakouts succeed. Price Action traders should be aware of fakeouts, where price briefly breaks a level but reverses.

Fibonacci retracement levels (e.g., 38.2%, 50%, 61.8%) often align with key Price Action levels. Combine these tools to:

Price Action is more than just a trading technique; it’s a skill that combines market analysis with psychology. By mastering the concepts outlined in this guide, from candlestick patterns to advanced strategies, you can confidently navigate financial markets with clarity and precision.

Remember, the key to becoming proficient in Price Action is practice and patience. Continuously refine your understanding, learn from your mistakes, and adapt to evolving market conditions.

Start your Price Action journey today and transform your trading approach into one grounded in simplicity and effectiveness. For further insights and in-depth resources, explore our other guides or connect with our community.

Take the first step now—your journey to Price Action mastery begins here!