Market Profile vs Volume Profile: Key Differences Explained

When navigating the complex world of trading and market analysis, traders often seek tools to better understand market dynamics and make more informed decisions. Among the advanced techniques available, Market Profile and Volume Profile stand out as powerful methods for analyzing price action and identifying key trading levels. However, understanding Market Profile vs Volume Profile—their differences, advantages, and applications—can often be challenging, especially for new traders.

Both tools serve unique purposes and cater to different aspects of market behavior. Market Profile emphasizes time spent at price levels, offering insights into the balance between buyers and sellers. On the other hand, Volume Profile focuses on the actual trading volume at each price level, providing critical information about liquidity and participation. Together, these tools can be transformative for traders looking to refine their strategies and gain a competitive edge.

In this article, we’ll explore the differences between Market Profile and Volume Profile, detailing their core features, use cases, and benefits. We’ll also provide actionable insights and practical tips for leveraging these tools in your trading. By the end, you’ll have a comprehensive understanding of how these profiles work, when to use them, and how to integrate them into your analysis.

To succeed in trading, it’s not enough to rely solely on price action or technical indicators. Understanding the forces behind price movements—such as market sentiment, liquidity, and participation—is crucial for identifying opportunities and minimizing risks.

Key Reasons to Master These Tools:

Whether you’re a day trader focusing on intraday moves or a swing trader analyzing long-term trends, mastering the differences between Market Profile and Volume Profile is essential for elevating your trading game.

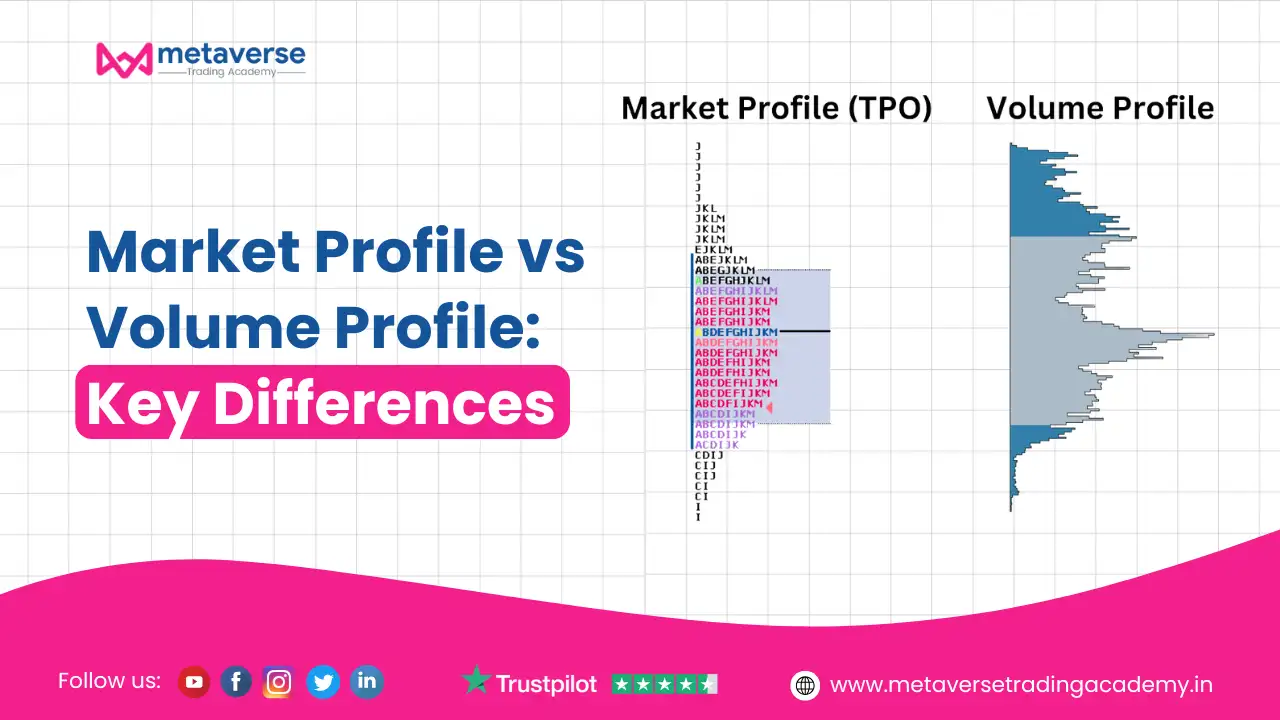

Market Profile is a time-based analysis tool that organizes price data into a distribution curve, providing a visual representation of where the market spends the most time. Developed by Peter Steidlmayer, Market Profile highlights areas of value and equilibrium, helping traders identify market sentiment and potential price reversals.

Volume Profile, in contrast, focuses on the volume traded at specific price levels. This volume-based tool provides a detailed view of market participation, highlighting areas of heavy trading activity (high-volume nodes) and low activity (low-volume nodes). Unlike Market Profile, Volume Profile is not tied to time, making it more adaptable across different timeframes.

To fully understand Market Profile vs Volume Profile, traders must grasp their core differences and how each tool can be used effectively.

Both tools share similar concepts like the Point of Control (POC) and Value Areas, but their calculations differ:

Pro Tip: Use overlapping POCs to confirm significant price levels.

Strengths:

Weaknesses:

Strengths:

Weaknesses:

Using both tools together can provide a more comprehensive view of market behavior. Here’s how you can integrate them into your strategy:

Ensure your trading platform supports both Market Profile and Volume Profile tools.

Understanding the differences between Market Profile vs Volume Profile is essential for traders who want to master market dynamics and make informed decisions. Market Profile excels at providing insights into market sentiment and value areas, while Volume Profile is invaluable for identifying liquidity and critical price zones.

By combining these tools, traders can gain a deeper understanding of the market, improving their ability to anticipate trends and execute precise trades. Whether you’re a day trader, swing trader, or long-term investor, mastering these profiles will enhance your analysis and decision-making.

Are you ready to take your trading skills to the next level? Start by integrating these tools into your strategy and experiment with different approaches to see what works best for your style. Share this article with fellow traders and explore our other resources for more advanced trading insights!

If you want to take your learning further, join Metaverse Trading Academy, where more than 50,000 students have already learned advanced strategies like Order Flow and Market Profile trading. Start your journey today at metaversetradingacademy.in.