Metaverse Trading Academy (NISM Registered) is best trading academy in india to learn stock trading using order flow, market profile, volume profile, option chain etc.

Rajkot, Gujarat, India

Order flow trading is a powerful strategy that provides traders with deep insights into market activity. By analyzing how orders enter and exit the market, traders can anticipate price movements with precision, making this method invaluable for beginners and seasoned traders alike.

For those looking to learn order flow trading, understanding its concepts is the first step toward unlocking its potential. With tools like heatmaps, depth-of-market (DOM) charts, and order book data, this approach can help you identify critical trading opportunities. In this guide, we’ll break down the essentials, actionable steps, and advanced tips to help you master order flow trading.

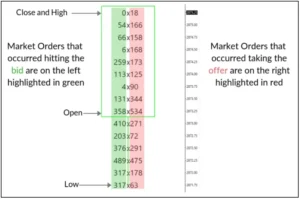

Order flow trading focuses on analyzing real-time market data to study buying and selling activity. Unlike technical analysis, which relies on historical patterns, order flow trading provides immediate insights into what traders are doing right now.

To learn order flow trading, you need the right tools.

Before diving into order flow, grasp market basics like:

To interpret order flow effectively, configure your charts with:

The depth-of-market (DOM) is a goldmine for order flow insights.

Leverage order flow data to spot setups:

Volume clusters represent areas where significant trading activity occurs within a narrow price range. These clusters often act as magnets for price, making them ideal for quick entry and exit points in scalping.

How to Use: Identify clusters on your charts and monitor how price interacts with these levels.

Tip: Combine volume clusters with time-based charts, such as 1-minute or 5-minute intervals, to enhance precision. This approach ensures you catch rapid price movements effectively, minimizing exposure to market volatility.

Delta measures the difference between aggressive buying and selling orders, offering insight into market sentiment.

Positive Delta: Indicates buyers are in control, pushing prices higher.

Negative Delta: Suggests sellers are dominating, leading to downward pressure.

By analyzing delta trends, traders can confirm the strength of a move or detect potential reversals. Use delta alongside order flow tools to validate your trading decisions and improve accuracy.

Stop-loss hunting occurs when institutional traders push prices to trigger clusters of stop-loss orders, creating liquidity sweeps.

How to Spot: Look for areas where stop-loss orders are likely placed, such as just above resistance or below support levels.

Strategy: Trade in the direction of the liquidity sweep once the stops are cleared. This approach allows you to capitalize on the sharp price movements that follow, often leading to high-reward setups.

[Image Suggestion: A trader making notes next to a chart with order flow annotations.]

Mastering order flow trading is a game-changer for traders aiming to gain an edge in volatile markets. By learning to analyze live market activity through tools like DOM charts, volume profiles, and footprint charts, you can identify high-probability trades and improve your trading accuracy.

If you’re looking to learn order flow trading, start with the basics, gradually integrate advanced strategies, and backtest rigorously to refine your skills. The journey may be challenging, but the rewards are worth it for those who remain disciplined and patient.

Ready to take your trading to the next level? Explore more resources, join trading communities, and start practicing today!