Delta Divergence: Spotting Market Reversals with Precision

Understanding market trends is a vital skill for any trader, and Delta Divergence has emerged as a powerful tool in spotting market reversals with precision. In trading, the difference between profit and loss often hinges on identifying these turning points before the majority of the market catches on.

Delta Divergence, a concept rooted in the analysis of volume and price action, offers traders a unique edge by providing early warning signals of potential trend shifts. By mastering this technique, you can refine your trading strategy, reduce risks, and maximize your gains. In this article, we’ll delve into what Delta Divergence is, why it matters, and how to use it effectively to identify market reversals.

At its core, Divergence involves analyzing the disparity between price movement and the delta of buy and sell orders. The term “delta” here refers to the difference between buying and selling volume within a specific timeframe. When price trends upward but the buying delta weakens—or vice versa—this discrepancy, known as Delta Divergence, can signal an impending market reversal.

To effectively use Divergence, you’ll need the right tools to track order flow and volume data. Some popular platforms for this include:

Key Points:

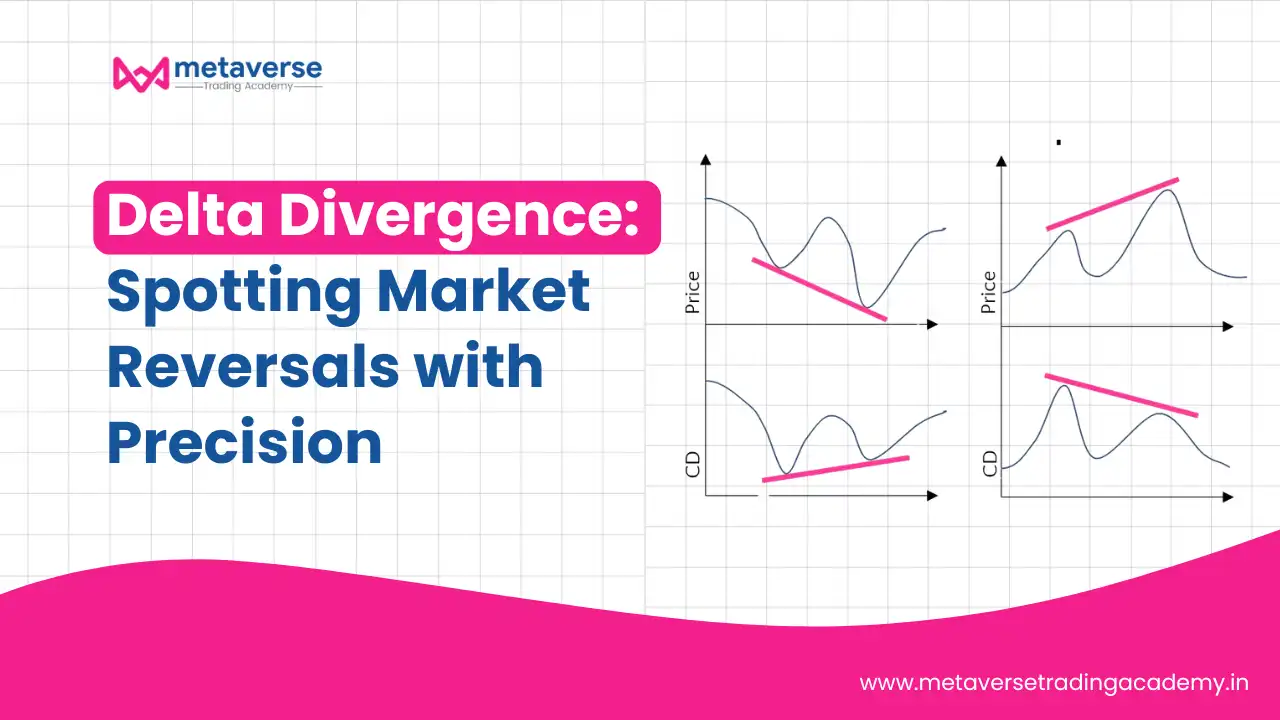

Delta Divergence typically manifests in two ways:

Actionable Steps:

While Delta Divergence is powerful, it works best in conjunction with broader market analysis. Consider the following:

Tips:

Identifying Delta Divergence is just the start. Effective application requires timing your trades precisely.

Entry Strategy:

Exit Strategy:

As with any trading tool, practice is key to mastering Divergence.

Steps to Improve:

To maximize your effectiveness with Delta Divergence, keep the following in mind:

Delta Divergence is more than just a trading tool—it’s a game-changer for spotting market reversals with precision. By analyzing the relationship between price movement and buying/selling activity, traders can identify turning points that others miss. Integrating this method into your trading strategy can give you the edge needed to stay ahead of the competition.

As with any trading strategy, success with Divergence requires practice, patience, and a commitment to continual learning. Start by backtesting the concepts, applying them in a demo environment, and refining your approach. By combining Divergence with broader market analysis, you’ll be well on your way to more confident and profitable trades.

Ready to elevate your trading strategy? Explore tools like cumulative delta indicators or order flow platforms to start applying Delta Divergence today! Read Now

For more trading insights and advanced strategies, subscribe to our newsletter or join our community of traders dedicated to mastering market trends. Let’s trade smarter together!