Delta and Imbalance Candle Breakout Strategy

In the world of financial markets, traders are always on the lookout for strategies that can offer consistency and reliable profits. The Delta and Imbalance Candle Breakout Strategy is a unique approach that has gained popularity for its potential to identify high-probability trade setups, providing traders with a strategic edge. By combining the principles of market imbalance with Delta, this method creates a powerful, signature strategy for navigating volatile markets and capitalizing on price movements.

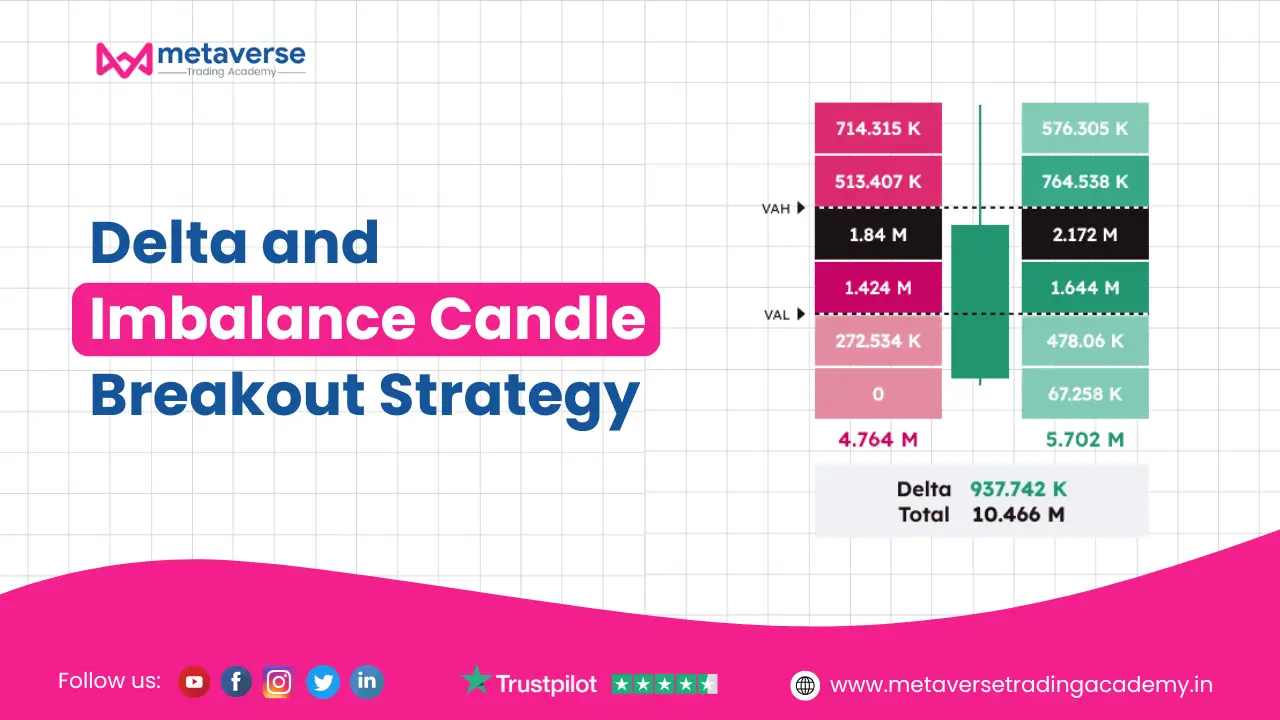

The term “Delta” in trading often refers to a measure of the rate of change in price concerning an underlying asset. In the context of the Delta and Imbalance Candle Breakout Strategy, it refers to the shifts in market sentiment and volume that indicate potential breakout points.

Before diving into the Delta and Imbalance Candle Breakout Strategy, it’s essential to first understand what Delta means in trading. The concept of Delta is derived from the idea of change and movement. In its simplest form, Delta measures the rate of price change in response to market conditions, particularly in the options market. However, in the context of this strategy, Delta can be seen as a reflection of the change in market sentiment, whether bullish or bearish, as price movements occur in response to imbalances.

In traditional trading, Delta often refers to the sensitivity of an option’s price to changes in the price of the underlying asset. However, in this strategy, Delta applies to the overall market sentiment. For example, a significant change in the price could indicate an imbalance between buying and selling pressure. Traders use these shifts in Delta to anticipate future price movements.

The Imbalance Candle Breakout Strategy involves identifying key candles that show a clear imbalance in market pressure—either a surge in buying or selling. An imbalance occurs when there is a sharp discrepancy between demand (buyers) and supply (sellers), resulting in price movements that often precede a larger breakout.

Here’s how the strategy works:

An imbalance occurs when the supply and demand of an asset are out of sync, creating pressure in the market. This can often be spotted with a large price spike or a substantial increase in volume. Here’s how to identify it:

Delta shifts represent changes in market sentiment, which often correlate with major price movements. A Delta shift can be detected by analyzing the price momentum in combination with the volume.

The breakout candle is crucial for confirming the shift in momentum. It provides a clear entry point for traders. A breakout candle is typically characterized by:

Before executing any trades, it’s important to prepare the market. This includes identifying the major support and resistance levels and watching for news events that could cause sudden imbalances in the market.

After market preparation, the next task is to spot potential imbalance candles. Look for large, body-filled candles that indicate the market’s strong movement in one direction. These candles should be accompanied by an increase in volume, signaling an imbalance between supply and demand.

Once an imbalance is spotted, start observing the Delta. A shift in Delta typically follows an imbalance candle, signaling the potential for a breakout. This shift could indicate a change in the market sentiment, either bullish or bearish.

Before entering a trade, wait for a breakout candle to confirm the breakout direction. This candle should have a clear bullish or bearish trend, with minimal wicks and a strong body.

Once confirmation is achieved, enter the trade by placing a buy or sell order, depending on the direction of the breakout. Always set stop-loss orders to minimize risk in case the market moves against you.

For a detailed walkthrough of the Delta and Imbalance Candle Breakout Strategy, check out our comprehensive video tutorial. This visual guide explains the core principles of the strategy, including how to analyze Delta shifts, spot market imbalances, and confirm breakout candles in real-time trading scenarios.

The Delta and Imbalance Candle Breakout Strategy is a powerful tool for identifying high-probability trading setups. By combining the concept of Delta with the identification of market imbalances, traders can anticipate potential breakouts with greater accuracy and confidence. This method relies on a systematic approach that includes observing market volume, detecting Delta shifts, and waiting for a breakout candle to confirm the trade direction.

As with any trading strategy, success lies in the consistent application of the principles, managing risk effectively, and continuously learning from market conditions. Whether you’re a novice trader or an experienced professional, incorporating the Delta and Imbalance Candle Breakout Strategy into your trading plan can significantly improve your chances of success.

If you want to take your learning further, join Metaverse Trading Academy, where more than 50,000 students have already learned advanced strategies like Order Flow and Market Profile trading. Start your journey today at metaversetradingacademy.in.